AMITBE said:

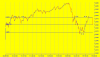

The 200 DMA tryst at 2913-1915 area is all but done, and we are in some tentative levels now.

One cannot say for how long the Nifty would play around here, and how far higher, if at all, the move may test.

For the record, 2991 is the 20 DMA.

2984 is the 20 EMA.

2883 is the 13 EMA.

This morning I had also mentioned 2865-2877 as being important levels.

These are a few important levels to keep in mind at this time, in case a trading range should develop in the very short term.

For now 2898-2886 forms an important support.

To the up a crossover at 2920-2926 could lead to test 2944.

One cannot say for how long the Nifty would play around here, and how far higher, if at all, the move may test.

For the record, 2991 is the 20 DMA.

2984 is the 20 EMA.

2883 is the 13 EMA.

This morning I had also mentioned 2865-2877 as being important levels.

These are a few important levels to keep in mind at this time, in case a trading range should develop in the very short term.

For now 2898-2886 forms an important support.

To the up a crossover at 2920-2926 could lead to test 2944.

Should one look for a dream move again, 2968 comes up, and if things get anywhere close to this, 2975 wouldn't be far.

The string is 2949-2952-2955-2958-2961 for now.

Only if 2944 cam be maintained.

This is the potential, from my data.