Elliott Wave theory - why does it work?

- Thread starter bvpraveen

- Start date

Sir, allow me to re-interpret this: (again you must not mistake me)

Basis of arguement: Rat poison helps cure common cold. (Let us assume that this type of rat poision is too complex in structure that labratories have not advanced enough to test it)

Doctor's arguement: "I am going to distribute this rat poision as a medicine to everyone who has common cold. If I have enough casualties whose death with proof that the death was caused by poisoning (remember, it cannot be studied in labs, yet...so there is no way to prove it), I shall stop it. Otherwise, with lack of evidence, I am not going to stop in my venture to eradicate common cold (intention though, was not to kill people and he truly believes this rat posion is helpful)!" . Knowing he is a doctor and has come out with a magical formula to cure common cold (which is considered terrible

by many), people fall prey for it.

By the time science developes, casualties would be quite high

Basis of arguement: Rat poison helps cure common cold. (Let us assume that this type of rat poision is too complex in structure that labratories have not advanced enough to test it)

Doctor's arguement: "I am going to distribute this rat poision as a medicine to everyone who has common cold. If I have enough casualties whose death with proof that the death was caused by poisoning (remember, it cannot be studied in labs, yet...so there is no way to prove it), I shall stop it. Otherwise, with lack of evidence, I am not going to stop in my venture to eradicate common cold (intention though, was not to kill people and he truly believes this rat posion is helpful)!" . Knowing he is a doctor and has come out with a magical formula to cure common cold (which is considered terrible

by many), people fall prey for it.

By the time science developes, casualties would be quite high

Let's, for a change, think of this from the point of view of the believers.

Is there any evidence of the existence of God? Yet for ages people have believed in the concept, derived strength & comfort from it (So much so that even the Emperor thanks the almighty

So why should we object if someone believes in a concept (that hasn't been conclusively disproved either) and finds it beneficial? (And as far as i can see, Asish isn't relying on EW alone but using it only as an additional filter to his trades)

Regards,

Kalyan.

U

I am here to develop myself in the process of money earning business & if possible to share.In this august forum i have FREELY given Metastock codes

(many have given & still giving) .Those free codes when backtested rigorously in all possible ways ,gives > 65 % winning over last 10 yrs of past data,with a 45 degree Equity Curve. A good standard System FREE (dream for new traders).Expect same attitude.

In life nobody & nothing can be perfect but one must try to enrich enlighten

self. by only bashing ,without helping me to learn by actually proving this wrong,only undermines that individuals basic wrong attitude.

Never equate humbelness with weakness ,i am a survivour of this Dog eats Dog trade.Can be counted as an average System trader (with >98 % winning probability,displayed in another thread).I know the basic rules of this game.

(many have given & still giving) .Those free codes when backtested rigorously in all possible ways ,gives > 65 % winning over last 10 yrs of past data,with a 45 degree Equity Curve. A good standard System FREE (dream for new traders).Expect same attitude.

In life nobody & nothing can be perfect but one must try to enrich enlighten

self. by only bashing ,without helping me to learn by actually proving this wrong,only undermines that individuals basic wrong attitude.

Never equate humbelness with weakness ,i am a survivour of this Dog eats Dog trade.Can be counted as an average System trader (with >98 % winning probability,displayed in another thread).I know the basic rules of this game.

C

EW works. Period

The problem lies with the text that is available(ie Prechter,Neely etc).The knowledge that they provide is their perception(which is absolutely wrong).Infact i can categorically say that why such softwares like RET,AGet give different counts is because of the knowledge that was made available to the software designers.The knowledge is incomplete.

Even with this limited knowledge(perhaps i shud rephrase it to incomplete knowledge)the profits that can be made is enormous(due to probability theory).

Case in my point is my suggestion to karthick long back that with time even caldaro will have to chnage his count on BSE which he did.This was b4 december when i wrote to him about market topping out.Numerous times in recent past i have made successful calls during intraday and projecting turn points,to some of my trader friends here.

Its the lack of application in thinking why the market is, as it is, and the incomplete material that is available to the public that is responsible for EW bashing and nothing else.

Trust me,it helps when u r prepared and when u know b4 others whats going to happen.

The problem lies with the text that is available(ie Prechter,Neely etc).The knowledge that they provide is their perception(which is absolutely wrong).Infact i can categorically say that why such softwares like RET,AGet give different counts is because of the knowledge that was made available to the software designers.The knowledge is incomplete.

Even with this limited knowledge(perhaps i shud rephrase it to incomplete knowledge)the profits that can be made is enormous(due to probability theory).

Case in my point is my suggestion to karthick long back that with time even caldaro will have to chnage his count on BSE which he did.This was b4 december when i wrote to him about market topping out.Numerous times in recent past i have made successful calls during intraday and projecting turn points,to some of my trader friends here.

Its the lack of application in thinking why the market is, as it is, and the incomplete material that is available to the public that is responsible for EW bashing and nothing else.

Trust me,it helps when u r prepared and when u know b4 others whats going to happen.

As I have said before, the question is not whether it works or not but it works against what standard. For eg. what is the need to call market tops or project turning points? Money is made in the NOW riding the current impulse if one needs to use the EW term for it.

Again on the question of a "Theory" working, there are hundreds of Mutual Funds that claim FA works but not half of them can beat their benchmarks unless its a wide bull market. So the question again is...The theory works against what standard. One can claim any theory works - CAPM, MACD, Financial Astrology because if they dont then one can do the exact opposite to make it work.The key term here is randomness, anything can work at any particular time.

Another thing is hard data, none of the EWers have collected any basic numbers something as basic as Forecast Error or %Accuracy.Human mind suffers from "restropective distortion", all theories seem to work in hindsight.

Just as a reference, I am not new to forecasting using EW and Gann however I wasnt able to gain any probabilistic insights using these theories because it is utterly determinstic ( One hypothesis is replaced by another if the situation changes )

http://epiktetos13.blogspot.com/2006/09/nf-daily.html

Its a amusing diversion to label waves etc but IMO it adds zero value to trading, distorting the NOW.There are much easier to implement and pragmatic theories than EW esp. for newbie traders given the learning curve of esoteric theories.

Last edited by a moderator:

C

My thoughts - once again...

Somehow there is a feeling by many people that trying EW can lead you to destruction. This need not be the case. Why dont you just set aside say 10% of your capital and trade using good EW principles? In the worst case, you will lose only 10% of your capital.

Somehow there is a feeling by many people that trying EW can lead you to destruction. This need not be the case. Why dont you just set aside say 10% of your capital and trade using good EW principles? In the worst case, you will lose only 10% of your capital.

There is a better idea, how about you start a journal here about the 'good EW principles" while collecting some basic stats and testing the 'accuracy'. You might also find some clients if it goes well.

As I have said before, the question is not whether it works or not but it works against what standard. For eg. what is the need to call market tops or project turning points? Money is made in the NOW riding the current impulse if one needs to use the EW term for it.

Again on the question of a "Theory" working, there are hundreds of Mutual Funds that claim FA works but not half of them can beat their benchmarks unless its a wide bull market. So the question again is...The theory works against what standard. One can claim any theory works - CAPM, MACD, Financial Astrology because if they dont then one can do the exact opposite to make it work.The key term here is randomness, anything can work at any particular time.

Another thing is hard data, none of the EWers have collected any basic numbers something as basic as Forecast Error or %Accuracy.Human mind suffers from "restropective distortion", all theories seem to work in hindsight.

Just as a reference, I am not new to forecasting using EW and Gann however I wasnt able to gain any probabilistic insights using these theories because it is utterly determinstic ( One hypothesis is replaced by another if the situation changes )

http://epiktetos13.blogspot.com/2006/09/nf-daily.html

Its a amusing diversion to label waves etc but IMO it adds zero value to trading, distorting the NOW.There are much easier to implement and pragmatic theories than EW esp. for newbie traders given the learning curve of esotreic theories.

Again on the question of a "Theory" working, there are hundreds of Mutual Funds that claim FA works but not half of them can beat their benchmarks unless its a wide bull market. So the question again is...The theory works against what standard. One can claim any theory works - CAPM, MACD, Financial Astrology because if they dont then one can do the exact opposite to make it work.The key term here is randomness, anything can work at any particular time.

Another thing is hard data, none of the EWers have collected any basic numbers something as basic as Forecast Error or %Accuracy.Human mind suffers from "restropective distortion", all theories seem to work in hindsight.

Just as a reference, I am not new to forecasting using EW and Gann however I wasnt able to gain any probabilistic insights using these theories because it is utterly determinstic ( One hypothesis is replaced by another if the situation changes )

http://epiktetos13.blogspot.com/2006/09/nf-daily.html

Its a amusing diversion to label waves etc but IMO it adds zero value to trading, distorting the NOW.There are much easier to implement and pragmatic theories than EW esp. for newbie traders given the learning curve of esotreic theories.

Correct labelling for future reference is done after market hours.He will be a fool who does it during market hours.That will be a lot of mental masturbation.

And y even try ot correctly label when u know whats going to happen.Whats the big deal in that,its just mental calculation.Later when u become adept in that it comes to u naturally,(Like duck taking to water)

Newbie traders will have to learn to first to apply themsleves.

Having said all this and heard all that,Food for one is poison for the other.

C

What makes you think,one who makes calls doesnt trade it.

Also since we are talking about probabilities here and since probabilities are always in a numerical form, can one gauge them using EW? For eg. What is the probability of price reversing at a W3 projection in a numerical form? I found there is none and hence its deterministic.Here is where I asked for some empirical data.

Correct labelling for future reference is done after market hours.He will be a fool who does it during market hours.That will be a lot of mental masturbation.And y even try ot correctly label when u know whats going to happen.Whats the big deal in that,its just mental calculation.Later when u become adept in that it comes to u naturally,(Like duck taking to water)

As I have said before, I am not debating whether it works or not. I am asking how useful it is for a daily trader to use EW, to make projections instead of probabilities and deal with subjectivity.

C

You must not mistake me but these are historical results from your data base of trades and are vulnerable to hindsight bias "after the fact". No one likes to reveal a loss making trade with waves or with any indicator/pattern.

By backtest, I mean something unbiased which people can reply upon...

By backtest, I mean something unbiased which people can reply upon...

C

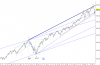

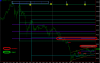

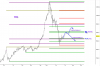

Some old EW charts of mine.As anyone can see, I have put in some effort into this and from that perspective I am asking whether it is indeed useful to subscribe to any market theories whatsoever, whatever those are.

Can I trade using EW? Yes. But then I can trade with a blank chart or just the MarketWatch in ODIN. One must rely on one's fundamental skill as a trader, not the analysis.

Can I trade using EW? Yes. But then I can trade with a blank chart or just the MarketWatch in ODIN. One must rely on one's fundamental skill as a trader, not the analysis.

Attachments

-

18.6 KB Views: 132

-

32.6 KB Views: 60

-

29.6 KB Views: 62

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| S | can u make elliott wave theory simplified | Technical Analysis | 2 | |

| 1 | Elliott Wave Theory | Technical Analysis | 616 | |

| J | Good Books on Elliott Wave Theory? | Books | 3 | |

|

|

Elliott Wave: The Best Of The Theory | AmiBroker | 1 | |

|

|

from where should we learn elliott wave theory | Technical Analysis | 5 |

Similar threads

-

-

-

-

-

from where should we learn elliott wave theory

- Started by rajatheroyal

- Replies: 5