NIFTY FIFTY

- Thread starter AMITBE

- Start date

- Status

- Not open for further replies.

nkpanjiyar said:

Amit, I think there will be lot of selling activity this week. What you say.

cheers,

nkpanjiyar

cheers,

nkpanjiyar

The lack of followup buying witnessed last week was due partially on account of the FIIs taking time off for vacation.

I believe more importantly, the smart money did a smart thing in not coming forward for two interconnected reasons:

The confusion over the record date for the demerger of Reliance and it's pack in relation to its valuations and its F&O expiry of the January contracts is the main reason.

The connected issue is that this confusion would whip-up a negative sentiment which would build furious shorts on Reliance, dragging it down.

We know only too well that the market treats any threat to Reliance as a trigger to go into correction, and especially so at historical levels. We are witnessing that now. Else, all of last week till Friday, the underlying strength in the market was quite palpable.

Should there be a positive sounding announcement from Reliance or SEBI or the exchanges or all of the above in the coming days, there may will be a strong reversal in Reliance and short covering etc. This would obviously push up the market, triggering some bullish levels, triggering short coverings on the Nifty etc.

This kind of couched manipulation is quite common as we all know. It would be back to business as usual, but the smart money would have multiplied itself in both directions.

So, it's an uncertain call NK, we can only wait for the events to unfold. It can still go either way.

What do you think?

Will post the technical issues later.

Amit, I am just sharing the summary of last week in my mailbox.

The indices started the week on a firm note as the Sensex crossed the 9400 mark on Monday. Both indices closed with gains of well over a per cent each as lower oil prices and firm global markets helped improve the sentiment.

Markets corrected on Tuesday after the indices touched new lifetime highs in early trades. After remaining subdued on Wednesday, the markets regained some strength on Thursday helped by ONGC and some banking stocks.

Friday saw new records for the indices in early trades. Sensex recorded a new intra-day lifetime high of 9443 during the week while the Nifty touched a high of 2857.

Both indices declined from their highs on Friday and closed more than a per cent each lower as profit booking emerged in many frontline stocks in afternoon trades.

The Sensex lost 27 points or 0.29 per cent during the week and the Nifty declined by 5 points or 0.18 per cent over the week.

There was not much action in mid-caps during the week as the index closed marginally lower. Sectors like sugar attracted a lot of interest and stock specific activity continued. The movement of the mid-cap index was in line with the frontline indices during the week. The CNX Mid-Cap 100 index lost 3 points or less than one-tenths of a per cent during the week.

The indices started the week on a firm note as the Sensex crossed the 9400 mark on Monday. Both indices closed with gains of well over a per cent each as lower oil prices and firm global markets helped improve the sentiment.

Markets corrected on Tuesday after the indices touched new lifetime highs in early trades. After remaining subdued on Wednesday, the markets regained some strength on Thursday helped by ONGC and some banking stocks.

Friday saw new records for the indices in early trades. Sensex recorded a new intra-day lifetime high of 9443 during the week while the Nifty touched a high of 2857.

Both indices declined from their highs on Friday and closed more than a per cent each lower as profit booking emerged in many frontline stocks in afternoon trades.

The Sensex lost 27 points or 0.29 per cent during the week and the Nifty declined by 5 points or 0.18 per cent over the week.

There was not much action in mid-caps during the week as the index closed marginally lower. Sectors like sugar attracted a lot of interest and stock specific activity continued. The movement of the mid-cap index was in line with the frontline indices during the week. The CNX Mid-Cap 100 index lost 3 points or less than one-tenths of a per cent during the week.

continued from last post:

Domestic economic and regulatory action

1) Merchandise exports during the month of November showed a decline of more than 10 per cent as compared to the same month of last year, the first monthly fall for more than three years. The fall in exports during a historically buoyant month is a cause for worry.

All the 3 major export items in the country's export basket like jewellery, textiles and engineering goods witnessed a decline during the month. Jewellery exports were the worst hit presumably because of record high prices of precious metals during the month.

The decline in exports of engineering goods and textiles are more worrying. Engineering exports have been growing at a healthy rate and textile exports had recovered from the early troubles of the post-quota regime. Textile exports should have shown robust growth for November as demand peaks before the year end holidays.

The government is hopeful that the dip in exports is only a temporary phenomenon and would pick up during the subsequent months of the current financial year. They point out that export growth during the same month of last year was as high as 40 per cent and the high base effect would have affected this year's growth rates.

2) The decline in exports and continued rise in imports have pushed up the trade deficit for the month of November to $3.74 billion from $2.16 billion for the same month of last year. Imports for the month rose more than 9 per cent with non-oil imports showing a growth of as much as 23 per cent.

Cumulative deficit for the first 8 months of the current year stands at more than $27 billion as compared to around $16 billion during the same period of last year. Full year deficit for the previous year was at $38 billion.

3) Further worsening of the external trade balance would impact the rupee considerably. The currency had weakened against the US dollar over the last couple of months before recovering partially during the last two weeks. Any decline in transfers by overseas Indians and investment flows from FII's next year could worsen the hit on the rupee.

4) Wholesale price inflation for the week ended 10 December declined marginally to 4.5 per cent from 4.55 per cent for the previous week. Prices of non-food items declined while textile prices went up. Prices of manufactured goods and food items were mostly unchanged during the week.

Domestic economic and regulatory action

1) Merchandise exports during the month of November showed a decline of more than 10 per cent as compared to the same month of last year, the first monthly fall for more than three years. The fall in exports during a historically buoyant month is a cause for worry.

All the 3 major export items in the country's export basket like jewellery, textiles and engineering goods witnessed a decline during the month. Jewellery exports were the worst hit presumably because of record high prices of precious metals during the month.

The decline in exports of engineering goods and textiles are more worrying. Engineering exports have been growing at a healthy rate and textile exports had recovered from the early troubles of the post-quota regime. Textile exports should have shown robust growth for November as demand peaks before the year end holidays.

The government is hopeful that the dip in exports is only a temporary phenomenon and would pick up during the subsequent months of the current financial year. They point out that export growth during the same month of last year was as high as 40 per cent and the high base effect would have affected this year's growth rates.

2) The decline in exports and continued rise in imports have pushed up the trade deficit for the month of November to $3.74 billion from $2.16 billion for the same month of last year. Imports for the month rose more than 9 per cent with non-oil imports showing a growth of as much as 23 per cent.

Cumulative deficit for the first 8 months of the current year stands at more than $27 billion as compared to around $16 billion during the same period of last year. Full year deficit for the previous year was at $38 billion.

3) Further worsening of the external trade balance would impact the rupee considerably. The currency had weakened against the US dollar over the last couple of months before recovering partially during the last two weeks. Any decline in transfers by overseas Indians and investment flows from FII's next year could worsen the hit on the rupee.

4) Wholesale price inflation for the week ended 10 December declined marginally to 4.5 per cent from 4.55 per cent for the previous week. Prices of non-food items declined while textile prices went up. Prices of manufactured goods and food items were mostly unchanged during the week.

continued from last post:

Industry developments

1) Sugar stocks were among the best performers in the stock markets in recent weeks. The crushing season is progressing smoothly and despite a rise in output, demand is expected to outpace supply this year as well. Sugar prices have also shown signs of firming up after remaining steady in recent months.

Some of the large sugar companies like Bajaj Hindustan have been on an expansion spree which should reflect in next year's performance. The short gestation period of new sugar mills help the industry to add capacity within a short period to take advantage of higher demand.

Sale of ethanol, used for blending petroleum fuels, and power is helping sugar companies to improve their bottom lines considerably. The companies have also improved their efficiencies significantly over the last few years and are now less dependent on regulatory policies. Some of the smaller companies have been aggressively importing raw sugar for reprocessing and sales in local markets.

The biggest policy hurdle for the growth of the industry is the continuing regulation of sugarcane prices. While sugar prices have been gradually decontrolled and mills are now able to get market price for their produce, except for the levy quota meant for the PDS system, cane prices continue to be regulated by the government.

Multiple cane prices announced by the central and state governments add to the problem. While the prices declared by the central government have been lower than those declared by states like UP, state government prices have been imposed on the mills helped by a Supreme Court ruling.

The agriculture and finance ministers have both stated recently that cane prices would also be decontrolled in the near future. Decontrol would lead to more efficiency in terms of better yields in the farm sector which had few incentives to improve yields in a regulated environment.

With improved efficiency and less policy hurdles, the sugar industry can look at exports as a big growth area in future. Sugar industry in Europe and elsewhere is supported by massive government subsidies, which would be gradually eased in the future.

2) Steel companies have been betting on steady product prices next year. Steel prices declined from their record highs during the early part of the year and have stabilised in recent months. Continuing demand from fast growing economies like China and India was expected to keep international steel prices steady during the next financial year.

However, the situation looks less rosy now. China has already become a net exporter and some of the smaller Indian steel companies who have been large exporters to China may find slow demand going forward. Product prices have been cut by most European and American steel producers over the last few months.

The latest company to announce a steep cut in prices is Posco of Korea, the fifth-largest steel manufacturer globally. The company announced price cuts of up to 17 per cent for various products this week. This follows a 20 per cent cut announced by Posco less than one month back.

While the more integrated steel companies with long term sales contracts for most of their output would not be much affected, the smaller and less integrated companies are sure to suffer. Most of these smaller companies are not as efficient as the larger ones and some of them still have very high interest costs.

Industry developments

1) Sugar stocks were among the best performers in the stock markets in recent weeks. The crushing season is progressing smoothly and despite a rise in output, demand is expected to outpace supply this year as well. Sugar prices have also shown signs of firming up after remaining steady in recent months.

Some of the large sugar companies like Bajaj Hindustan have been on an expansion spree which should reflect in next year's performance. The short gestation period of new sugar mills help the industry to add capacity within a short period to take advantage of higher demand.

Sale of ethanol, used for blending petroleum fuels, and power is helping sugar companies to improve their bottom lines considerably. The companies have also improved their efficiencies significantly over the last few years and are now less dependent on regulatory policies. Some of the smaller companies have been aggressively importing raw sugar for reprocessing and sales in local markets.

The biggest policy hurdle for the growth of the industry is the continuing regulation of sugarcane prices. While sugar prices have been gradually decontrolled and mills are now able to get market price for their produce, except for the levy quota meant for the PDS system, cane prices continue to be regulated by the government.

Multiple cane prices announced by the central and state governments add to the problem. While the prices declared by the central government have been lower than those declared by states like UP, state government prices have been imposed on the mills helped by a Supreme Court ruling.

The agriculture and finance ministers have both stated recently that cane prices would also be decontrolled in the near future. Decontrol would lead to more efficiency in terms of better yields in the farm sector which had few incentives to improve yields in a regulated environment.

With improved efficiency and less policy hurdles, the sugar industry can look at exports as a big growth area in future. Sugar industry in Europe and elsewhere is supported by massive government subsidies, which would be gradually eased in the future.

2) Steel companies have been betting on steady product prices next year. Steel prices declined from their record highs during the early part of the year and have stabilised in recent months. Continuing demand from fast growing economies like China and India was expected to keep international steel prices steady during the next financial year.

However, the situation looks less rosy now. China has already become a net exporter and some of the smaller Indian steel companies who have been large exporters to China may find slow demand going forward. Product prices have been cut by most European and American steel producers over the last few months.

The latest company to announce a steep cut in prices is Posco of Korea, the fifth-largest steel manufacturer globally. The company announced price cuts of up to 17 per cent for various products this week. This follows a 20 per cent cut announced by Posco less than one month back.

While the more integrated steel companies with long term sales contracts for most of their output would not be much affected, the smaller and less integrated companies are sure to suffer. Most of these smaller companies are not as efficient as the larger ones and some of them still have very high interest costs.

continued from last post:

US markets, global economy and oil

1) US markets closed almost unchanged for the week as the indices struggled to get a direction before the holidays. The economic data released during the week was also mixed and added to the market sentiment. Consumer price inflation for November showed only a marginal rise, which should ease concerns about further rise in interest rates. Corporate results for the week were also mixed.

The Dow closed marginally higher for the week while the S&P 500 closed one-tenth of a per cent higher. Technology stocks recovered from their weakness during the early part of the week but the NASDAQ index still closed with marginal losses.

2) Authorities in China declared this week that they have been underestimating the size of their economy for many years now. Some economic activities, mostly in the services sector, were said to have been underreported during the previous years. This has led to an upward revision of the last year Chinese GDP aggregate by as much as 17 per cent. Revision would also be effected for the previous years as well, which would reduce the need to correct the growth rates as reported earlier.

The immediate impact of the Chinese GDP revision is that it provides further ammunition to countries like the US to demand accelerated reforms by China. The US has been seeking further appreciation of the Chinese currency to reduce the trade imbalances between the two countries. Trade disputes between China and its trading partners mostly stem from the impression that China is benefiting from many unfair policies adopted by its government.

3) Crude prices ended the week on a steady note as a decline in US inventories was offset by forecasts of lower demand for heating oil. The commodity remained flat during the earlier part of the week before gaining on lower US stocks data. Crude lost ground again by the close of the week as winter demand for heating oil is expected to decline by next month. January futures on the NYMEX closed the week at $58.43 per barrel.

4)OPEC, the cartel of oil exporters, is reportedly revising its expected price band for crude oil to between $50 and $60 per barrel for NYMEX grade. This would translate to an average realisation of $45 to $55 per barrel for the OPEC grade of heavy crude produced by member countries.

OPEC had set its target below $50 per barrel earlier, but is now seeking higher prices as the world economy has withstood the oil rally of recent years. Most OPEC members have said that the current oil prices are fair as it ensures adequate supplies without hurting consumer countries too much. Oil exporters are experiencing strong economic growth fuelled by the additional revenues from oil sales.

5) Meanwhile, OPEC is expected to leave production quotas of member countries unchanged at its next meeting in January. Production quotas are not enforced strictly and member countries often exceed or fall short depending on demand. OPEC countries currently produce close to 30-million barrels of crude per day or over one-third of world output.

Some members like Venezuela have already demanded a cut in OPEC production next year to hold prices at these levels. OPEC had earlier forecast higher demand for crude next year, helped by continued growth in Chinese demand. OPEC production quotas have a significant impact on oil prices as it is a key sentiment driver.

cheers,

nkpanjiyar

US markets, global economy and oil

1) US markets closed almost unchanged for the week as the indices struggled to get a direction before the holidays. The economic data released during the week was also mixed and added to the market sentiment. Consumer price inflation for November showed only a marginal rise, which should ease concerns about further rise in interest rates. Corporate results for the week were also mixed.

The Dow closed marginally higher for the week while the S&P 500 closed one-tenth of a per cent higher. Technology stocks recovered from their weakness during the early part of the week but the NASDAQ index still closed with marginal losses.

2) Authorities in China declared this week that they have been underestimating the size of their economy for many years now. Some economic activities, mostly in the services sector, were said to have been underreported during the previous years. This has led to an upward revision of the last year Chinese GDP aggregate by as much as 17 per cent. Revision would also be effected for the previous years as well, which would reduce the need to correct the growth rates as reported earlier.

The immediate impact of the Chinese GDP revision is that it provides further ammunition to countries like the US to demand accelerated reforms by China. The US has been seeking further appreciation of the Chinese currency to reduce the trade imbalances between the two countries. Trade disputes between China and its trading partners mostly stem from the impression that China is benefiting from many unfair policies adopted by its government.

3) Crude prices ended the week on a steady note as a decline in US inventories was offset by forecasts of lower demand for heating oil. The commodity remained flat during the earlier part of the week before gaining on lower US stocks data. Crude lost ground again by the close of the week as winter demand for heating oil is expected to decline by next month. January futures on the NYMEX closed the week at $58.43 per barrel.

4)OPEC, the cartel of oil exporters, is reportedly revising its expected price band for crude oil to between $50 and $60 per barrel for NYMEX grade. This would translate to an average realisation of $45 to $55 per barrel for the OPEC grade of heavy crude produced by member countries.

OPEC had set its target below $50 per barrel earlier, but is now seeking higher prices as the world economy has withstood the oil rally of recent years. Most OPEC members have said that the current oil prices are fair as it ensures adequate supplies without hurting consumer countries too much. Oil exporters are experiencing strong economic growth fuelled by the additional revenues from oil sales.

5) Meanwhile, OPEC is expected to leave production quotas of member countries unchanged at its next meeting in January. Production quotas are not enforced strictly and member countries often exceed or fall short depending on demand. OPEC countries currently produce close to 30-million barrels of crude per day or over one-third of world output.

Some members like Venezuela have already demanded a cut in OPEC production next year to hold prices at these levels. OPEC had earlier forecast higher demand for crude next year, helped by continued growth in Chinese demand. OPEC production quotas have a significant impact on oil prices as it is a key sentiment driver.

cheers,

nkpanjiyar

Thanks NK for the summary.

To salvage one positive from the drubbing today, 2745 survived after some pretty tough repeated struggles there. In fact the last traded value was 2745 off and the closing value came slightly higher at 2749 off. It was mentioned as the outer most level for the Nifty where it would enter the deeper end still.

It's merely a sliver of a hope for survival, and even a sliver is hope enough under the circumstances.

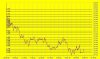

The intraday chart is enclosed with all the levels given in the various posts.

To salvage one positive from the drubbing today, 2745 survived after some pretty tough repeated struggles there. In fact the last traded value was 2745 off and the closing value came slightly higher at 2749 off. It was mentioned as the outer most level for the Nifty where it would enter the deeper end still.

It's merely a sliver of a hope for survival, and even a sliver is hope enough under the circumstances.

The intraday chart is enclosed with all the levels given in the various posts.

Attachments

-

77 KB Views: 16

The sellout yesterday wasn’t expected to be quite so hard.

Some weakness had crept in Friday last, but the holding out of 2799 and the close above 2804 held the promise that 2788 would find a strong support or certainly 2764 would.

My belief as mentioned in the last post yesterday is that some opportunistic players taking advantage at the lack of follow up buying last week, and the confusion and fear of the Reliance demerger details etc, indulged in heavy selling leading to panic.

These chaps will be back to buying soon enough and will then make a killing again to the up.

When re entry seems like a good idea the Big Funds would be back to buying too, Christmas vacation or no Christmas vacation.

Big money or not so big money, these have never allowed a nebulous factor such as vacations to stand in the way of profit making opportunities.

And when would an opportunity be deemed as seductive enough?

Obviously the formation of an important bottom would be it.

2745 was mentioned as one such level.

But yesterday it was repeatedly under threat and the close at 2749 sits precariously close to it. However it did seem resilient enough to at least once sharply push the Nifty back towards 2764, and for the rest braved the savaging all day.

So I am still eyeing 2745 as being it.

The only other level in the 2700s that could do the job is 2721.

About the research here, so far a few factors seem to be right on track.

The levels of conflict are coming along rather nicely and the intraday charts uploaded at close depict the levels mentioned through the day very clearly.

Certain important days mentioned here have played along fairly well too.

The difficulty lies in assessing them and interpreting them.

Yesterday was meant to be a pointer for things to come, but ended up being the mover.

Still, today and Dec 29 are still pending this week and we’ll see where they take things.

More on this later as I’m running out of time here.

The levels:

2764 has to be taken and held without dithering for a return to higher levels.

2721 may form a base.

To the up are 2752-2754-2756-2758-2764.

If 2764 is taken and held, 2775 becomes the immediate target with 2769 and 2772 in the way.

Pushing this through now and will edit to post down levels very soon.

The down levels are 2742-2739-2737-2735-2731-2729-2727-2725-2723-2721.

If more are needed will post later

Some weakness had crept in Friday last, but the holding out of 2799 and the close above 2804 held the promise that 2788 would find a strong support or certainly 2764 would.

My belief as mentioned in the last post yesterday is that some opportunistic players taking advantage at the lack of follow up buying last week, and the confusion and fear of the Reliance demerger details etc, indulged in heavy selling leading to panic.

These chaps will be back to buying soon enough and will then make a killing again to the up.

When re entry seems like a good idea the Big Funds would be back to buying too, Christmas vacation or no Christmas vacation.

Big money or not so big money, these have never allowed a nebulous factor such as vacations to stand in the way of profit making opportunities.

And when would an opportunity be deemed as seductive enough?

Obviously the formation of an important bottom would be it.

2745 was mentioned as one such level.

But yesterday it was repeatedly under threat and the close at 2749 sits precariously close to it. However it did seem resilient enough to at least once sharply push the Nifty back towards 2764, and for the rest braved the savaging all day.

So I am still eyeing 2745 as being it.

The only other level in the 2700s that could do the job is 2721.

About the research here, so far a few factors seem to be right on track.

The levels of conflict are coming along rather nicely and the intraday charts uploaded at close depict the levels mentioned through the day very clearly.

Certain important days mentioned here have played along fairly well too.

The difficulty lies in assessing them and interpreting them.

Yesterday was meant to be a pointer for things to come, but ended up being the mover.

Still, today and Dec 29 are still pending this week and we’ll see where they take things.

More on this later as I’m running out of time here.

The levels:

2764 has to be taken and held without dithering for a return to higher levels.

2721 may form a base.

To the up are 2752-2754-2756-2758-2764.

If 2764 is taken and held, 2775 becomes the immediate target with 2769 and 2772 in the way.

Pushing this through now and will edit to post down levels very soon.

The down levels are 2742-2739-2737-2735-2731-2729-2727-2725-2723-2721.

If more are needed will post later

Last edited:

- Status

- Not open for further replies.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| M | Nifty option strategy chart in Dhan Optiontrader | Brokers & Trading Platforms | 3 | |

| S | EOD data for Nifty 50 with volume | Introductions | 0 | |

| L | Nifty fifty and stock futures | Swing Trading | 13 | |

| M | Veluri Strategy intraday nifty fifty | Software | 96 | |

| T | Nifty Fifty Only + GOLD SILVER | Data Feeds | 0 |

Similar threads

-

Nifty option strategy chart in Dhan Optiontrader

- Started by MetatraderUser

- Replies: 3

-

-

-

-