Options Open Interest Analyser

Heavy built up of options on a strike price works like magnet in the market

To trade in options is interesting but after knowing some different characteristics about it, makes much more interesting to play with options. It’s for me like magic, and now I want to discuss with you guys and obviously I need your feedback too. If you know this magic, you will feel like you can predict the market in short term very well. The only condition for the magic is to love the numbers.

This magic contains for results like:-

1. When to buy the market or showing the strength of the market

2. Grab the opportunity to sell or indicating weakness in the market

3. Find the support by options

4. Find the resistance by options

Now the main idea starts from here:-

1. When to buy the market:-

When the market is going up, and simultaneously ATM and ITM put options show a heavy fresh build up, indicates the strength of the market and if it follows with unwinding of ATM and OTM call options, it tells good sustainable rally in the market.

For example:-

Nifty is trading at 5740, and 5700 strike put option is showing fresh build up or the open interest increases with heavy quantity followed by 5800 and higher strike puts. And simultaneously 5800 call option decreases heavy open interest followed by 5900 and higher strike call options.

So what do they signify 5700 and 5800 put and call option unwinding and fresh build up?

According to the my logic market maker or institutions sell the options, I mean only sell and only sell and create volume in the market. And for institutions they take profit out of the market a huge profit out of the market. Now you would think, why I am telling you about them? So it’s just like if you don’t know much about something just try to understand the big player or the master blaster in the game, So in our game its them or the market maker, institutions or specified hedge funds for selling options. Because as per general perception retailers or investors avoid to short options, as it carries higher risk and it requires high margin, so they prefer to trade long position.

Now to carry forward our example that when the market is going up or consolidating to go up or in the near term if market will bullish, it will fetch fresh writing of at the money put options or in the money put options. And it will also carry with unwinding of short position in call options. So according to the example market is trading at 5740 and 5700 strike put show heavy fresh add on in open interest followed by any of the 5800 and 5900. And as well with the declining in the 5800, 5900 call options open interest. So jump to buy at that point because this is going to tell you the master blasters of the game is shorting put options and buy back their short calls, as they are like to see rally in the market.

2. When to sell the market:-

When market is trading at a relatively higher level or showing bit distribution, keep watching options activity and when ATM and ITM put options shows unwinding and ATM and ITM call options shows fresh build up. That’s it you got your point to sell.

For example:-

Suppose nifty is trading at 5960 and 6000 strike call option shows significant increase in call option open interest followed by 5900 and lower strikes. And simultaneously 6000 put option shows significant decline in open interest indicates, weakness is going to resume in the market and market is heading for downward.

In this example increase in 6000 call option open interest indicates call are written or sold in large quantity and decrease in 6000 put option tells the buyback of option positions, which was written earlier. So by fresh call writing and buying back the written put option indicates it’s the time for bears. Start to sell the market.

“It’s just like in the Technical Analysis that follows the trend and our magic say follow the master blasters (big traders/institutions) of the game……. Isn’t it interesting?”

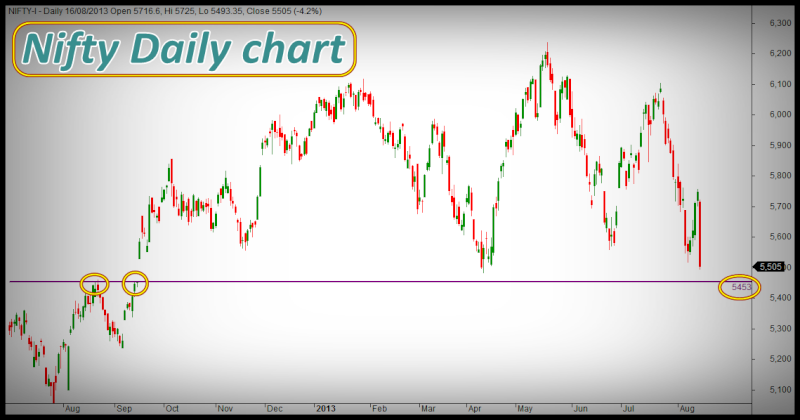

3. Find the Support:-

Finding support of the market with the help of charts requires a lot of historical data but for this not that much. Just look at the options activity and crunch the open interest numbers with the price level of the market.

If the market is going down and near OTM strike put option adds a large chunk of fresh open interest, this strongly emphasis that the strike price is going to hold the market in the coming few sessions or make bottom at that level for the current expiry.

For example:- If we take the second example forward then if the market going down below 5960 and 5900 put option open interest shows fresh build up and making the highest OI strike price in the puts. So in this example 5900 can be strong support as fresh positions are built up while market is going down, as we see these fresh built up initiated by writing puts. Hence the master blasters of our game come into picture again, as this big chunk of option writing and especially when market is falling cannot be initiated by small traders. So think…..think…. and think this is going to be very interesting.

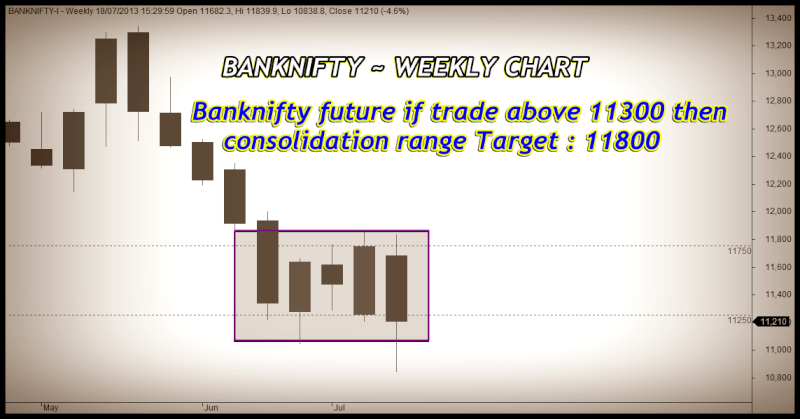

4. FIND THE RESISTANCE:-

When the market is going up, the near strike price accumulating highest OI in call options adds fresh positions, this would be your resistance, obviously it would be in short term.

For example:-

If we see the first example for this point then find that if market is trading at 5740 with positive bias, and at that point of time if 5800 strike call option adding fresh open interest and become the highest OI holder in call option type. Then at that time 5800 would be your resistance in that case. And this indicates that market will be unable or will take some time to break 5800 in the upside, so that short position would get the time value of money benefit.

I hope it would be exciting you to check it out on live trading. Yes do it for sure and for this magic you should love numbers and track them. This magic would surely work if you track them and work according to the principle as I have mentioned.

I will write in the next article about the implied volatility mixing it with open interest, this will blunder you for making profit from the market.

Thanks,

Anil

Heavy built up of options on a strike price works like magnet in the market

To trade in options is interesting but after knowing some different characteristics about it, makes much more interesting to play with options. It’s for me like magic, and now I want to discuss with you guys and obviously I need your feedback too. If you know this magic, you will feel like you can predict the market in short term very well. The only condition for the magic is to love the numbers.

This magic contains for results like:-

1. When to buy the market or showing the strength of the market

2. Grab the opportunity to sell or indicating weakness in the market

3. Find the support by options

4. Find the resistance by options

Now the main idea starts from here:-

1. When to buy the market:-

When the market is going up, and simultaneously ATM and ITM put options show a heavy fresh build up, indicates the strength of the market and if it follows with unwinding of ATM and OTM call options, it tells good sustainable rally in the market.

For example:-

Nifty is trading at 5740, and 5700 strike put option is showing fresh build up or the open interest increases with heavy quantity followed by 5800 and higher strike puts. And simultaneously 5800 call option decreases heavy open interest followed by 5900 and higher strike call options.

So what do they signify 5700 and 5800 put and call option unwinding and fresh build up?

According to the my logic market maker or institutions sell the options, I mean only sell and only sell and create volume in the market. And for institutions they take profit out of the market a huge profit out of the market. Now you would think, why I am telling you about them? So it’s just like if you don’t know much about something just try to understand the big player or the master blaster in the game, So in our game its them or the market maker, institutions or specified hedge funds for selling options. Because as per general perception retailers or investors avoid to short options, as it carries higher risk and it requires high margin, so they prefer to trade long position.

Now to carry forward our example that when the market is going up or consolidating to go up or in the near term if market will bullish, it will fetch fresh writing of at the money put options or in the money put options. And it will also carry with unwinding of short position in call options. So according to the example market is trading at 5740 and 5700 strike put show heavy fresh add on in open interest followed by any of the 5800 and 5900. And as well with the declining in the 5800, 5900 call options open interest. So jump to buy at that point because this is going to tell you the master blasters of the game is shorting put options and buy back their short calls, as they are like to see rally in the market.

2. When to sell the market:-

When market is trading at a relatively higher level or showing bit distribution, keep watching options activity and when ATM and ITM put options shows unwinding and ATM and ITM call options shows fresh build up. That’s it you got your point to sell.

For example:-

Suppose nifty is trading at 5960 and 6000 strike call option shows significant increase in call option open interest followed by 5900 and lower strikes. And simultaneously 6000 put option shows significant decline in open interest indicates, weakness is going to resume in the market and market is heading for downward.

In this example increase in 6000 call option open interest indicates call are written or sold in large quantity and decrease in 6000 put option tells the buyback of option positions, which was written earlier. So by fresh call writing and buying back the written put option indicates it’s the time for bears. Start to sell the market.

“It’s just like in the Technical Analysis that follows the trend and our magic say follow the master blasters (big traders/institutions) of the game……. Isn’t it interesting?”

3. Find the Support:-

Finding support of the market with the help of charts requires a lot of historical data but for this not that much. Just look at the options activity and crunch the open interest numbers with the price level of the market.

If the market is going down and near OTM strike put option adds a large chunk of fresh open interest, this strongly emphasis that the strike price is going to hold the market in the coming few sessions or make bottom at that level for the current expiry.

For example:- If we take the second example forward then if the market going down below 5960 and 5900 put option open interest shows fresh build up and making the highest OI strike price in the puts. So in this example 5900 can be strong support as fresh positions are built up while market is going down, as we see these fresh built up initiated by writing puts. Hence the master blasters of our game come into picture again, as this big chunk of option writing and especially when market is falling cannot be initiated by small traders. So think…..think…. and think this is going to be very interesting.

4. FIND THE RESISTANCE:-

When the market is going up, the near strike price accumulating highest OI in call options adds fresh positions, this would be your resistance, obviously it would be in short term.

For example:-

If we see the first example for this point then find that if market is trading at 5740 with positive bias, and at that point of time if 5800 strike call option adding fresh open interest and become the highest OI holder in call option type. Then at that time 5800 would be your resistance in that case. And this indicates that market will be unable or will take some time to break 5800 in the upside, so that short position would get the time value of money benefit.

I hope it would be exciting you to check it out on live trading. Yes do it for sure and for this magic you should love numbers and track them. This magic would surely work if you track them and work according to the principle as I have mentioned.

I will write in the next article about the implied volatility mixing it with open interest, this will blunder you for making profit from the market.

Thanks,

Anil