Use ful thread

15-min intraday setup

by: Swingking

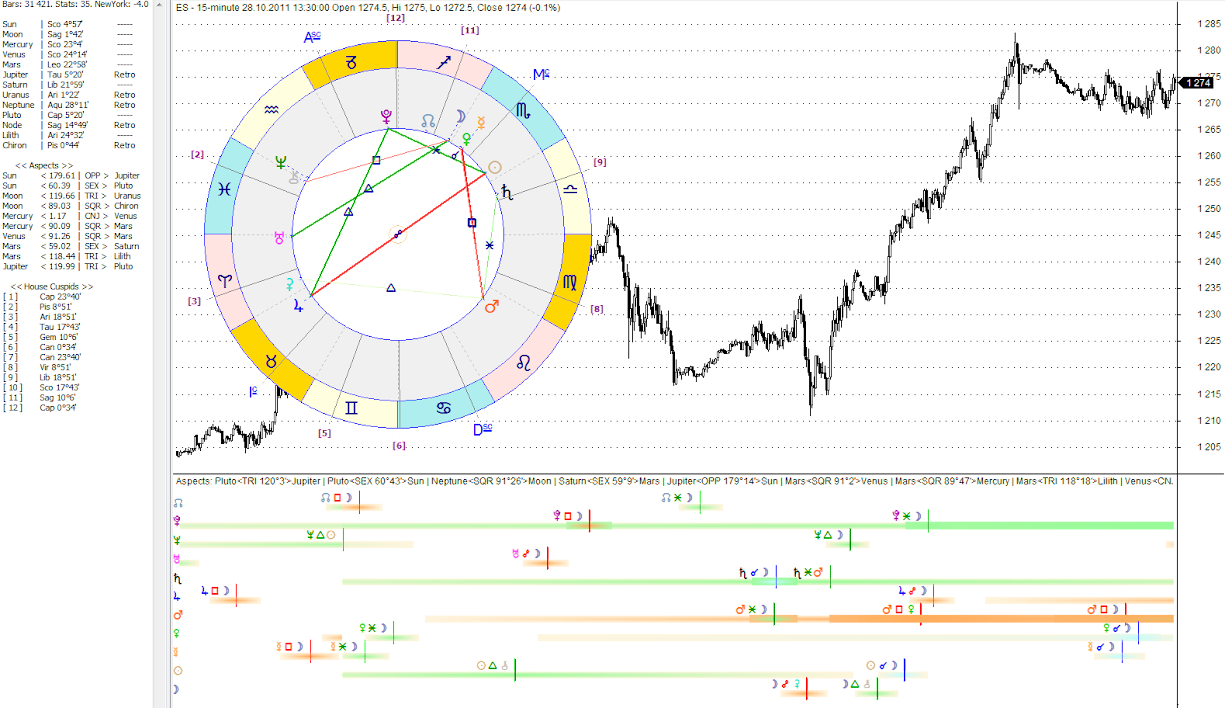

requirement � candlestick charts/bar charts with macd (standard setting) and ma (50), ema (20) and ema (10)

brief introduction � i came across this setup while watching greg capra's seminar. I have modified this setup based on my trading experience.

I have added the macd indicator for filtering out bad trades. The setup is simple to understand and implement. This setup is extremely effective to day trade and can get about 30-50 points on the nifty. Please use this strategy on nifty as i have researched this setup on it.

trade setup - pick a stock which has run up quite a bit and is due for a correction. A typical setup occurs when the 50 ma slopes down (with angle between 20-30) and prices fall sharply. Eventually prices retrace back to 20 ema or 10 ema which also happens to be the 38 -50% retracement from the swing high. Enter a short position at this point and book profits according to your own appetite.

example - in an example shown below, nifty has run up quite a bit and has formed a new high. Prices start to drop off from this level. Over the period of two days, the slope of 50 sma starts to curve down and the setup is formed. Prices fall off on 14th sharply and then retrace back to 20 ema on the 15th. This level is also between 38.2 and 50% retracement level from swing high. Macd slope is negative and is about to turn below zero. Ideal setup for a short trade.

stoploss - stoploss if it breaches the 20 ema and reaches the 50 sma. Ideally, one can stop if the trade breaches 20 ema.

usage - this pattern can be used on 15min charts for day trades.

by: Swingking

requirement � candlestick charts/bar charts with macd (standard setting) and ma (50), ema (20) and ema (10)

brief introduction � i came across this setup while watching greg capra's seminar. I have modified this setup based on my trading experience.

I have added the macd indicator for filtering out bad trades. The setup is simple to understand and implement. This setup is extremely effective to day trade and can get about 30-50 points on the nifty. Please use this strategy on nifty as i have researched this setup on it.

trade setup - pick a stock which has run up quite a bit and is due for a correction. A typical setup occurs when the 50 ma slopes down (with angle between 20-30) and prices fall sharply. Eventually prices retrace back to 20 ema or 10 ema which also happens to be the 38 -50% retracement from the swing high. Enter a short position at this point and book profits according to your own appetite.

example - in an example shown below, nifty has run up quite a bit and has formed a new high. Prices start to drop off from this level. Over the period of two days, the slope of 50 sma starts to curve down and the setup is formed. Prices fall off on 14th sharply and then retrace back to 20 ema on the 15th. This level is also between 38.2 and 50% retracement level from swing high. Macd slope is negative and is about to turn below zero. Ideal setup for a short trade.

stoploss - stoploss if it breaches the 20 ema and reaches the 50 sma. Ideally, one can stop if the trade breaches 20 ema.

usage - this pattern can be used on 15min charts for day trades.